Bitcoin Holds Above $66K, but Elevated Funding Rates Call for Caution

Bitcoin remains on the offensive, thanks to ProShares Bitcoin Strategy ETF’s strong debut on the New York Stock Exchange earlier this week. The cryptocurrency bounced to $66,400, having found bids near $64,000 during the Asian hours. Analysts foresee a rally toward $86,000 in the coming weeks. However, it may not be a smooth ride, as […]

Don't got time to read? Listen it & multi task

Bitcoin remains on the offensive, thanks to ProShares Bitcoin Strategy ETF’s strong debut on the New York Stock Exchange earlier this week. The cryptocurrency bounced to $66,400, having found bids near $64,000 during the Asian hours.

- Analysts foresee a rally toward $86,000 in the coming weeks. However, it may not be a smooth ride, as the derivatives market is beginning to show signs of overheating – often a recipe for price pullbacks.

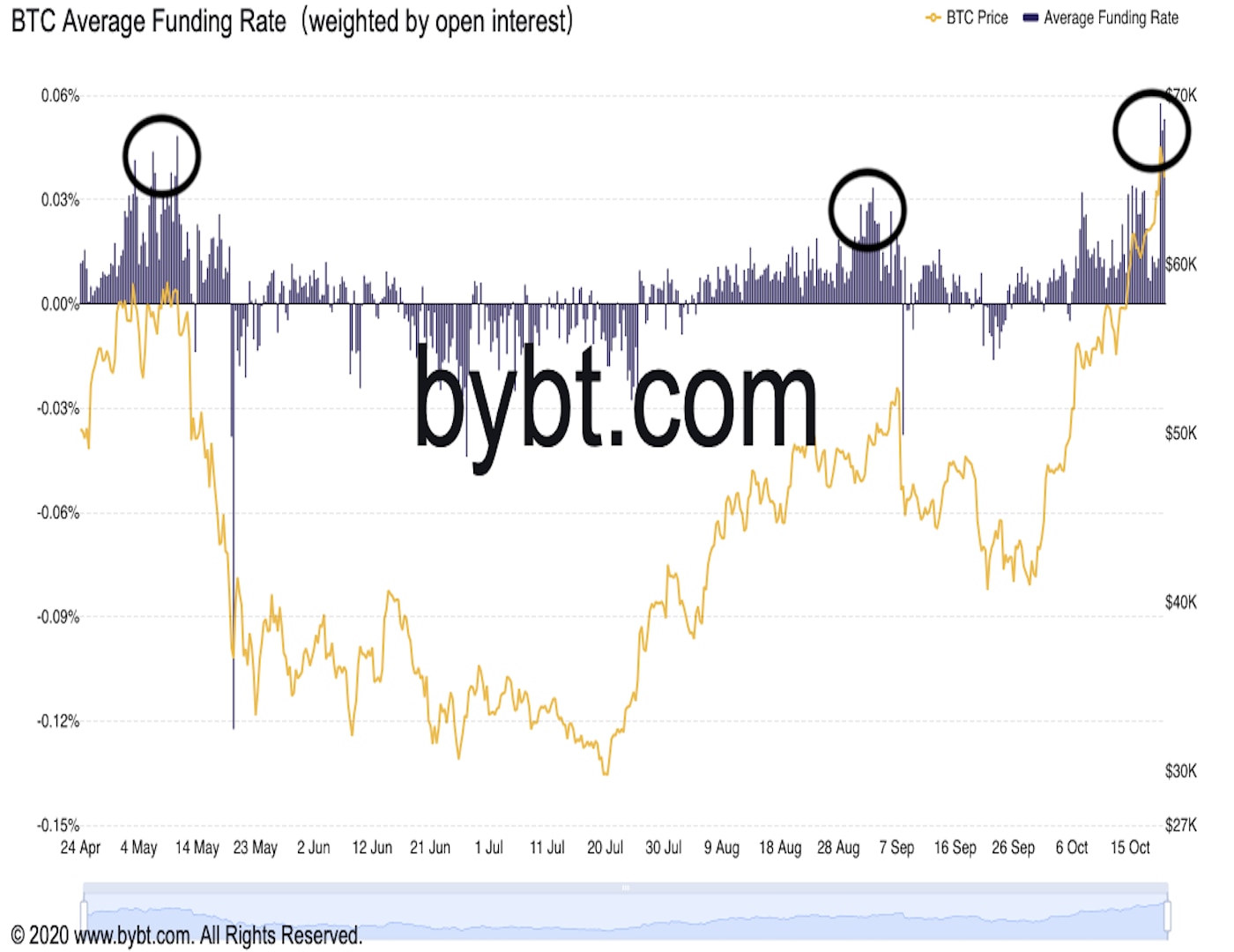

- Bitcoin’s average funding rate or the cost of holding long positions in the perpetual futures listed on major exchanges, including Binance, has risen to 0.06% – the highest in at least six months, according to data provided by Bybit. Exchanges calculate funding rates every eight hours.

- On retail-focused exchange Bybit, the funding rate surged as high as 0.14% early today.

- “Participants need to pay close attention to the exchange funding rates represented by Bybit, where retail investors are more concentrated, and excessive rates may trigger another short-term price downturn,” Babel Finance mentioned in the weekly research note published Monday.

- While funding rates seen at press time are significantly higher than those seen before the early September sell-off and the mid-May price crash, they are not yet as high as the ones seen during the first quarter bull frenzy.

- Although a positive funding rate represents an upbeat market mood, a very high reading indicates that the leverage is heavily skewed on the bullish side and often paves the way for price pullbacks.

- Stack Fund’s COO and Co-Founder Matthew Dibb said elevated funding rates might inject volatility into the market. “Our expectation is that capital will rotate into ethereum and major altcoins while bitcoin cools off slightly,” Dibb added.