$60,000 would be a monthly record, but longstanding analysis demands a minimum of $63,000 by the start of November. Bitcoin (BTC) delivered fresh retests of $60,000 support on Oct. 31 with a matter of hours left until the crucial monthly close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Record monthly close hangs by a thread […]

$60,000 would be a monthly record, but longstanding analysis demands a minimum of $63,000 by the start of November.

Bitcoin (BTC) delivered fresh retests of $60,000 support on Oct. 31 with a matter of hours left until the crucial monthly close.

Record monthly close hangs by a thread

Data from Cointelegraph Markets Pro and TradingView showed lackluster price action on Sunday, with BTC/USD below the “worst case scenario” for its October close.

Analysts were eagerly awaiting to see if the end of the month could provide a turnaround and prove the worst case theory correct for a third month running.

Its creator, PlanB, father of the stock-to-flow model, correctly guessed the $47,000 and $43,000 finales for August and September respectively.

Even without succeeding, however, finishing October above $60,000 would mark several achievements in itself.

If #Bitcoin closes the week tomorrow above $60k, it would be the 3rd week in a row…

It would also be the first *MONTHLY* close above $60k ever.

— Benjamin Cowen (@intocryptoverse) October 30, 2021

As Cointelegraph previously noted, Sundays have tended to see weaker performance from Bitcoin this month, with Monday contrasting the mood with a show of strength — particularly into the U.S. open.

“BTC daily says get ready for November,” popular trader and analyst TechDev summarized on the day, putting the focus on the coming month.

Shiba Inu ends its run in altcoin slowdown

Altcoins staged copycat moves as Bitcoin waned, with the top ten cryptocurrencies by market cap seeing modest losses over the past 24 hours.

Related: Bitcoin eyes third weekly close above $60K as Ethereum fuels new altcoin market cap record

Shiba Inu (SHIB), the star of the past week, lost more heavily, down 13% at the time of writing but still with weekly gains of 45%.

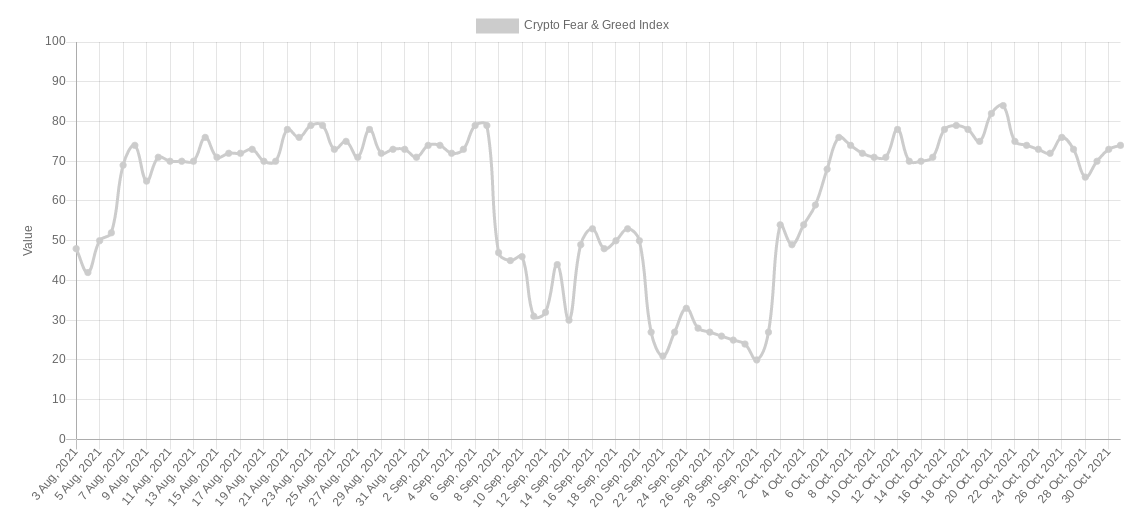

Sentiment mimicked the lack of upside, with the Crypto Fear & Greed Index showing declining “greed” in recent days.