In order to gauge retail investors’ stock market knowledge, the online casino reviewer GamblersPick spoke to more than 1,000 people who have invested at least once. According to the survey results, respondents who owned cryptocurrencies scored significantly lower than investors who didn’t own any crypto. The results also revealed that 70% of digital investors have […]

In order to gauge retail investors’ stock market knowledge, the online casino reviewer GamblersPick spoke to more than 1,000 people who have invested at least once.

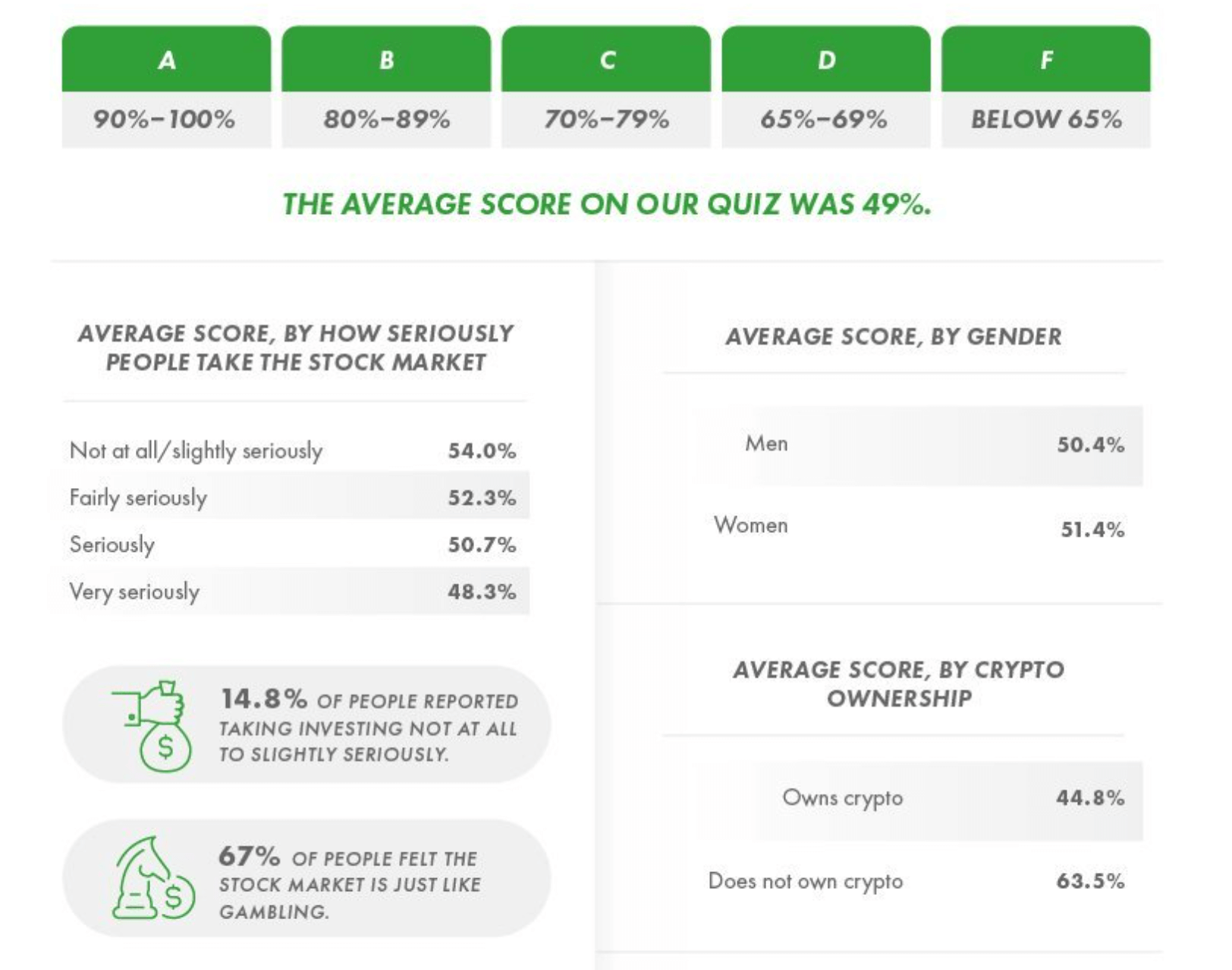

According to the survey results, respondents who owned cryptocurrencies scored significantly lower than investors who didn’t own any crypto.

The results also revealed that 70% of digital investors have invested in Bitcoin (BTC), compared to 39% who invested in Litecoin (LTC), the second most popular coin.

Top Portfolio Choices

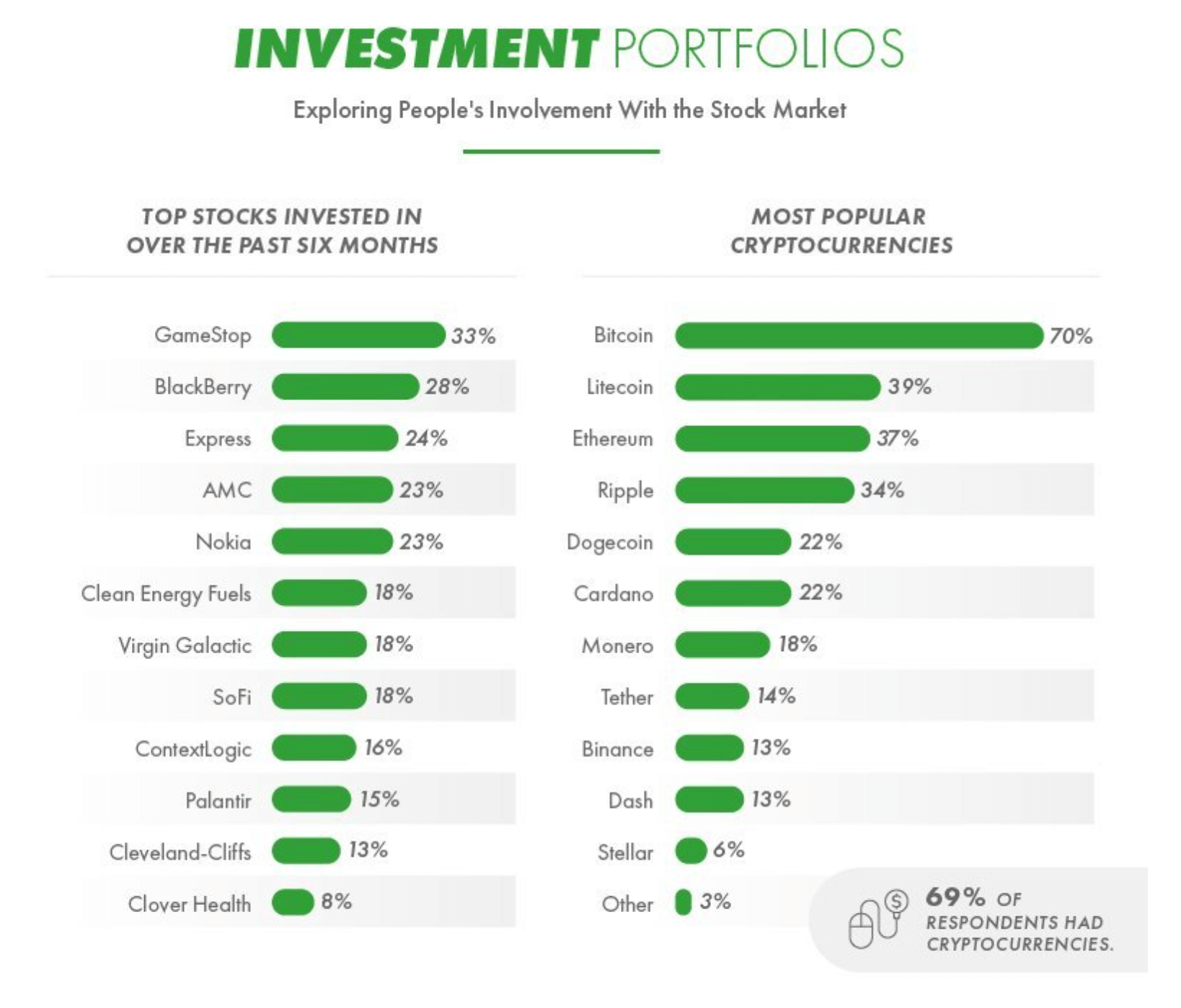

The study first asked the participants about what they’ve invested in and discovered that 69% of respondents owned cryptocurrencies.

In continuation, the report looked at which stocks and cryptocurrencies are most popular among retail investors.

“GameStop was the most popular stock for our respondents in the last six months. A third of investors had put their money on this company,” read the report, adding that the second most popular choice was another “meme stock,” BlackBerry.

As far as cryptocurrencies go, the world’s largest crypto surfaced as the most popular by far, with 70% of digital investors responding they bought Bitcoin.

While 39% of respondents said that they invested in Litecoin, 37% reported they bought Ethereum (ETH).

How much do newbie investors know?

“Swathes of new investors have entered the stock market since the pandemic, with first-timers now making up 15% of all retail investors,” the report pointed out, as it continued to address the most common knowledge gaps.

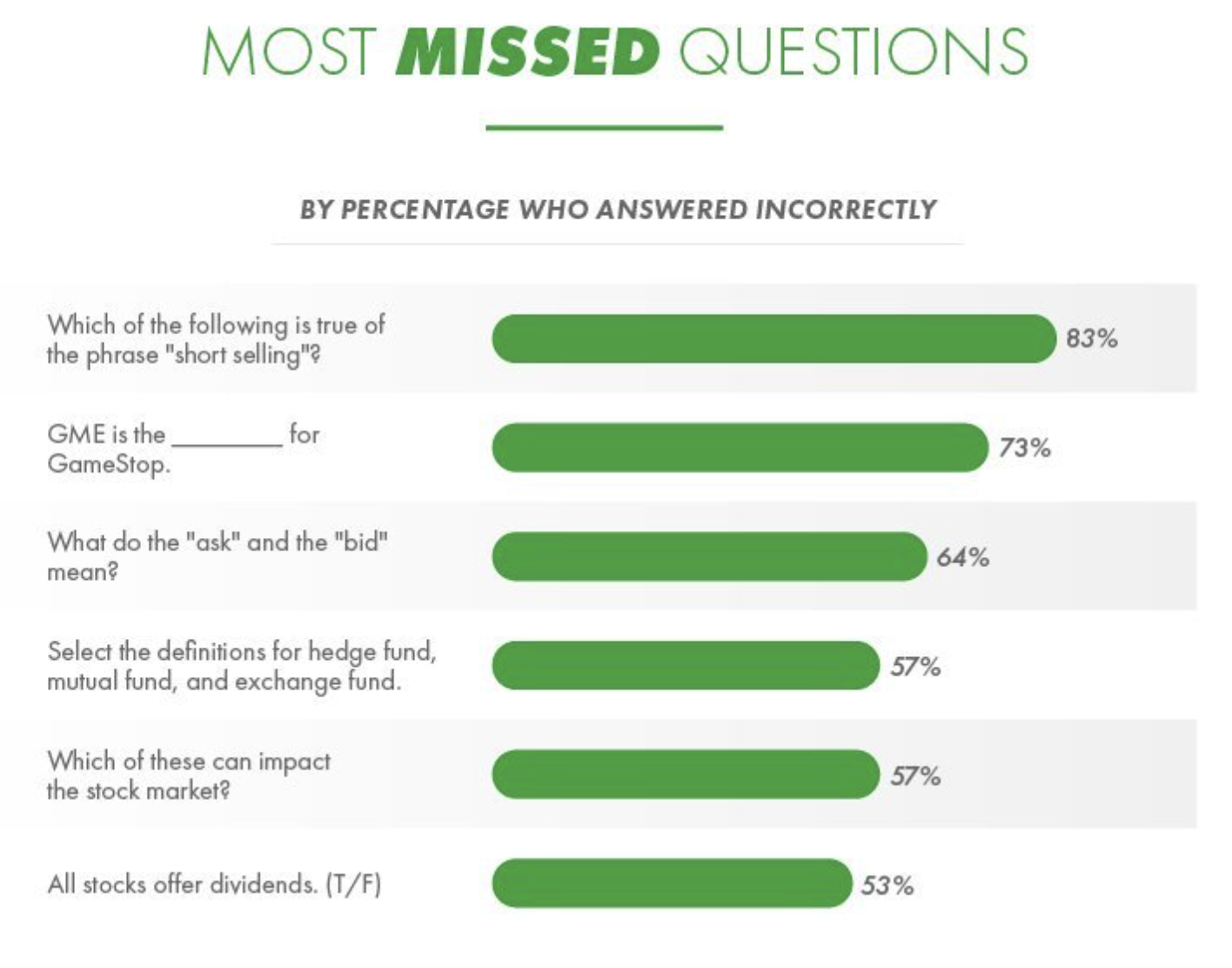

In spite of the short sell behind the GameStop frenzy, 83% of respondents didn’t properly identify the “short selling” definition in a multiple choice question.

Short selling implies borrowing a share of a stock and then selling it.

If the price performs as anticipated, traders can rebuy the stock when its price falls and hold onto the difference.

In addition, most people couldn’t identify the correct term for the abbreviation GME, as 73% of respondents failed to recognize it as an example of a “ticker symbol.”

More than half of investors couldn’t properly explain what the “ask” and the “bid” were.

In simple words, the “bid” price is the maximum amount that a buyer is prepared to pay for a stock, while the “ask” is the minimum price that a seller would take for that same stock.

Other common knowledge gaps surfaced when the respondents were asked to correctly define “hedge funds,” “mutual funds,” and “exchange funds.”

“What made the real difference was whether or not a person owned cryptocurrencies,” read the report, noting that those who did not performed much better than those who did.

According to GamblersPick, one of the possible explanations is that cryptocurrencies tend to appeal to younger and less experienced investors.

It could also be the case that crypto investors are opting out of the traditional stock market altogether and have little interest in gaining stock market knowledge.

Besides gauging knowledge gaps, the survey also explored the general attitude towards the market and investing, and revealed that 67% of the respondents felt the stock market is just like gambling.

The post Report: Crypto investors score poorly on basic stock market knowledge appeared first on CryptoSlate.