Chinese New Year is on Sunday, Jan. 22, marking the beginning of a week-long national holiday in China, which is often accompanied by high volatility in the market. This is called the “golden week” and is the biggest national holiday in China. Each year is accompanied by one of twelve animals, and 2023 will be […]

Chinese New Year is on Sunday, Jan. 22, marking the beginning of a week-long national holiday in China, which is often accompanied by high volatility in the market.

This is called the “golden week” and is the biggest national holiday in China. Each year is accompanied by one of twelve animals, and 2023 will be “The Year of the Rat”.

Both the Shanghai and Shenzhen Stock Exchanges will be closed from Monday to Friday (Jan. 23 to 27). This will impact the stock market due to the massive amounts of volume being taken away from the global markets. As a result, this can increase volatility since assets can more easily be manipulated. Moreover, there is often profit-taking in the days preceding the New Year since people often need cash to buy gifts.

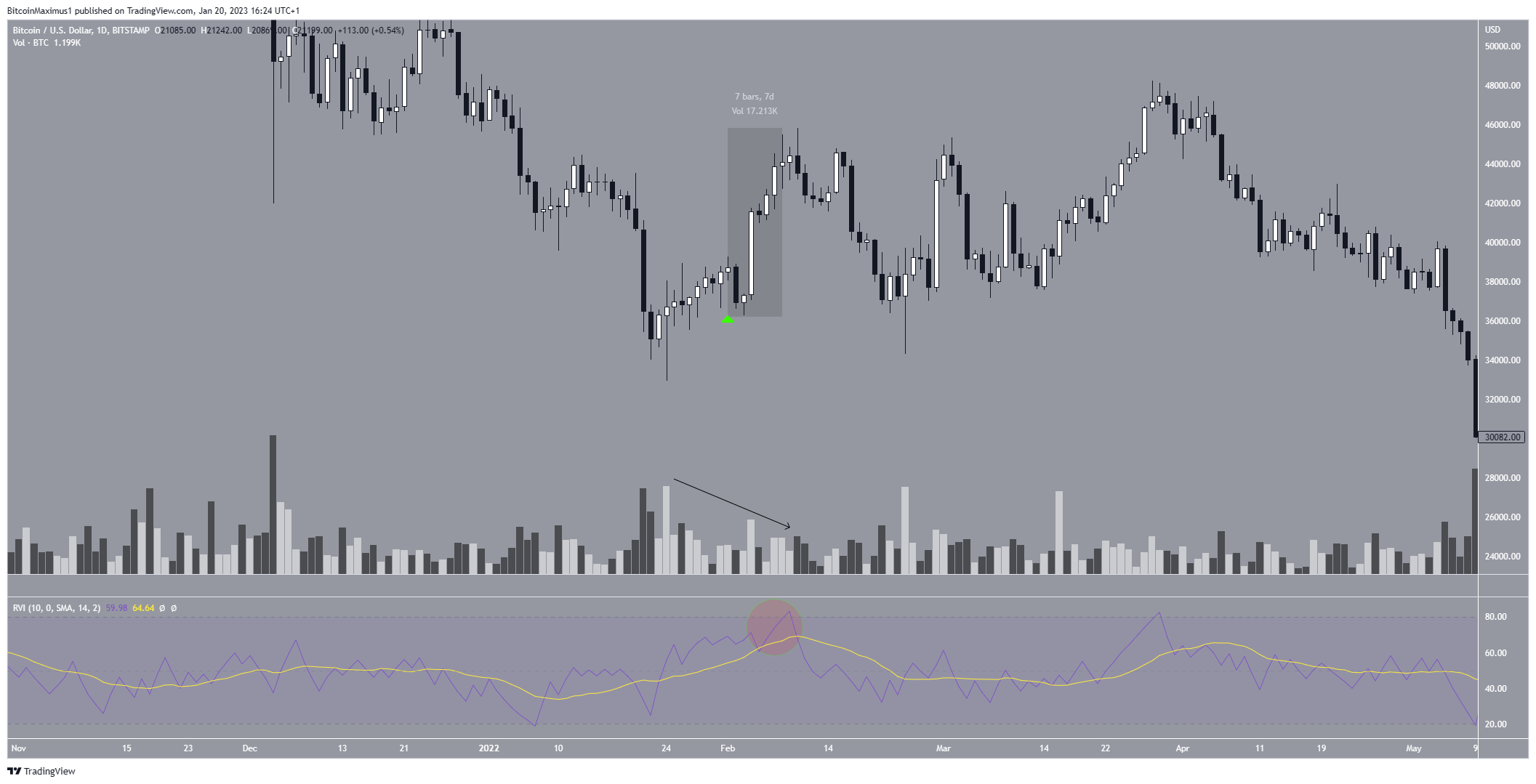

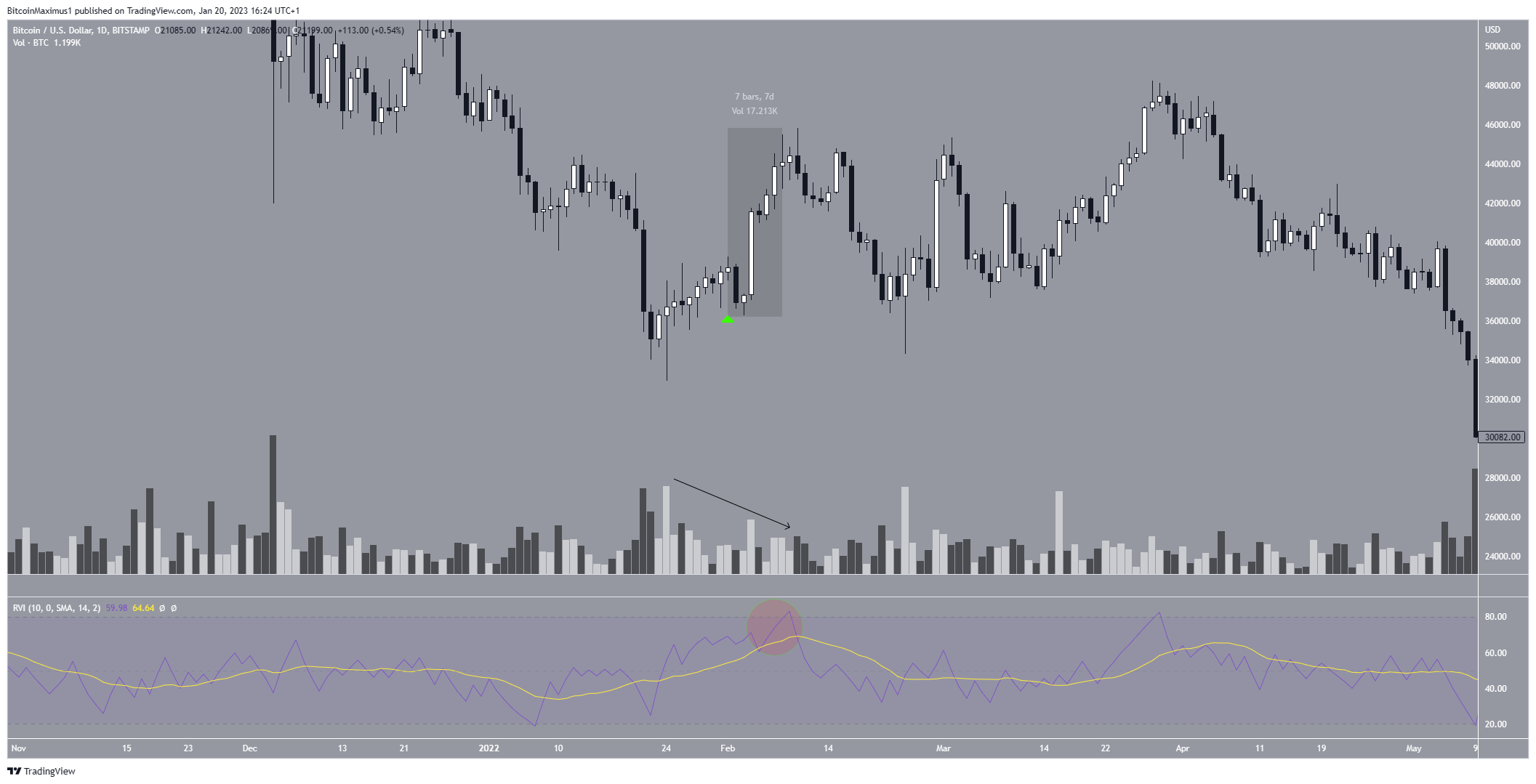

2022 Lunar New Year Led to Bitcoin Rally

The Chinese New Year in 2022 (Year of the Tiger) started on Tuesday, Feb. 1, (green icon). Therefore, the week from Feb. 1-8 was the golden week (highlighted).

The Bitcoin (BTC) price increased considerably during this week but fell sharply afterward, losing all of its previous gains.

However, the most interesting development during this time was the massive increase in relative volatility, which reached a nearly six-month peak on Feb. 8 (green circle), the last day of the golden week.

As outlined prior, the low volume (black arrow) during this week could have been a reason for the volatility.

Since the Bitcoin price lost all of its gains afterward, we cannot state that the “golden week” has a long-lasting effect on the digital asset’s price. However, the increased volatility offers numerous opportunities for day trading.

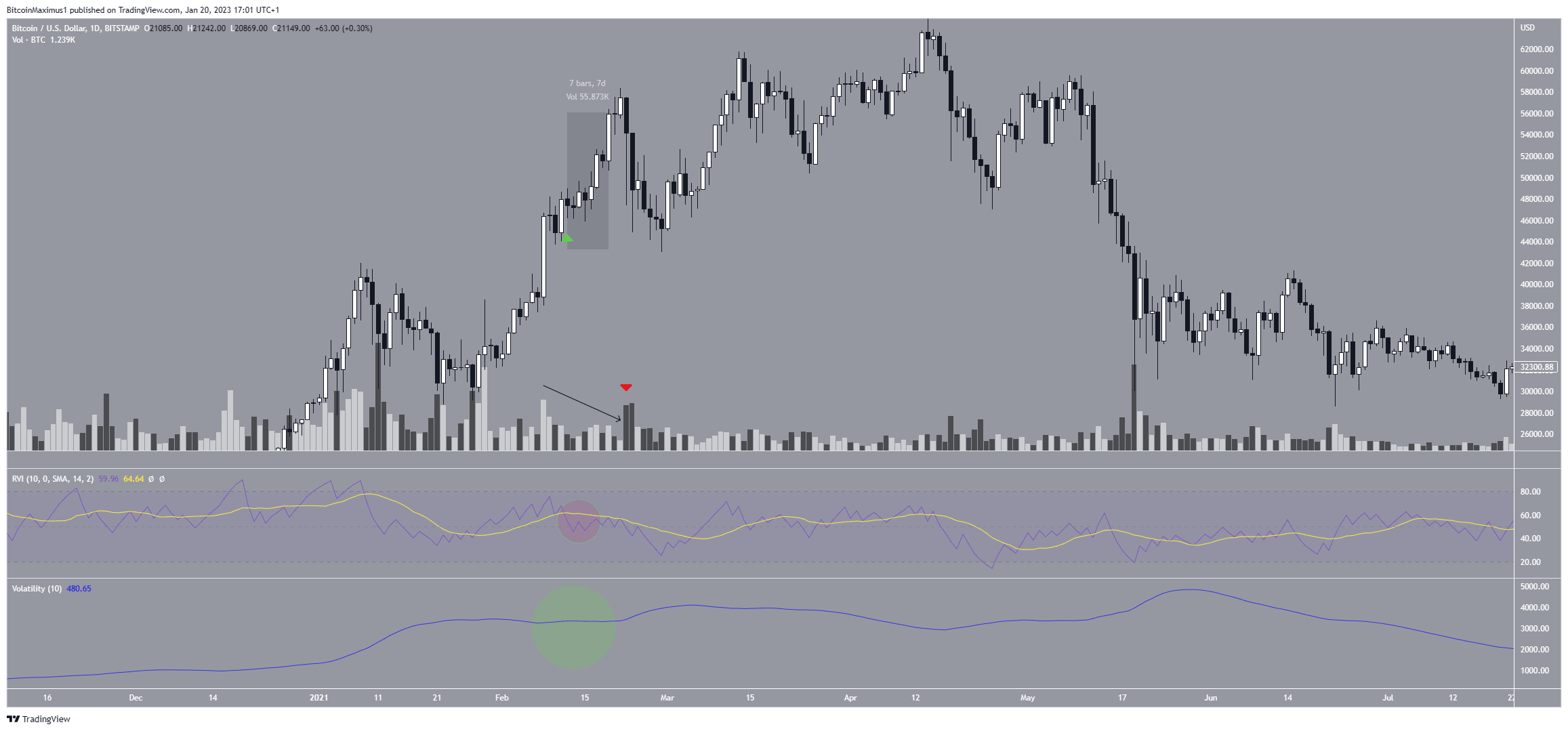

2021 Gave Low Volume but Average Volatility

The Chinese New Year in 2021 (Year of the Ox) began on Friday, Feb. 12 (green icon). The BTC price increased during the next seven days and peaked two days after the golden week (highlighted), more specifically on Feb. 21. Like 2022, it lost all of its gains afterward.

The golden week was characterized by very low volume (black icon), which picked up in the ensuing drop (red icon).

Interestingly, volatility wasn’t as high as in 2022. In fact, it was slightly lower than average (red circle). A potential reason for this could be that there was extreme volatility before the new year, hence the relative volatility failed to increase. This is confirmed when looking at the volatility in absolute terms (green circle), which had an extremely high reading of ,3100.

To conclude, the week following the Chinese New Year has historically been combined with very low volume and average to high volatility. The main reason for this is likely the closing of Chinese stock exchanges, which due to the low volume levels, makes it easier to move prices. Interestingly, in 2021 and 2022 the Bitcoin price increased considerably before losing all of its gains afterward.

For BeInCrypto’s latest crypto market analysis, click here.

The post Why Volatility Could Strike the Crypto Market Ahead of Chinese New Year appeared first on BeInCrypto.