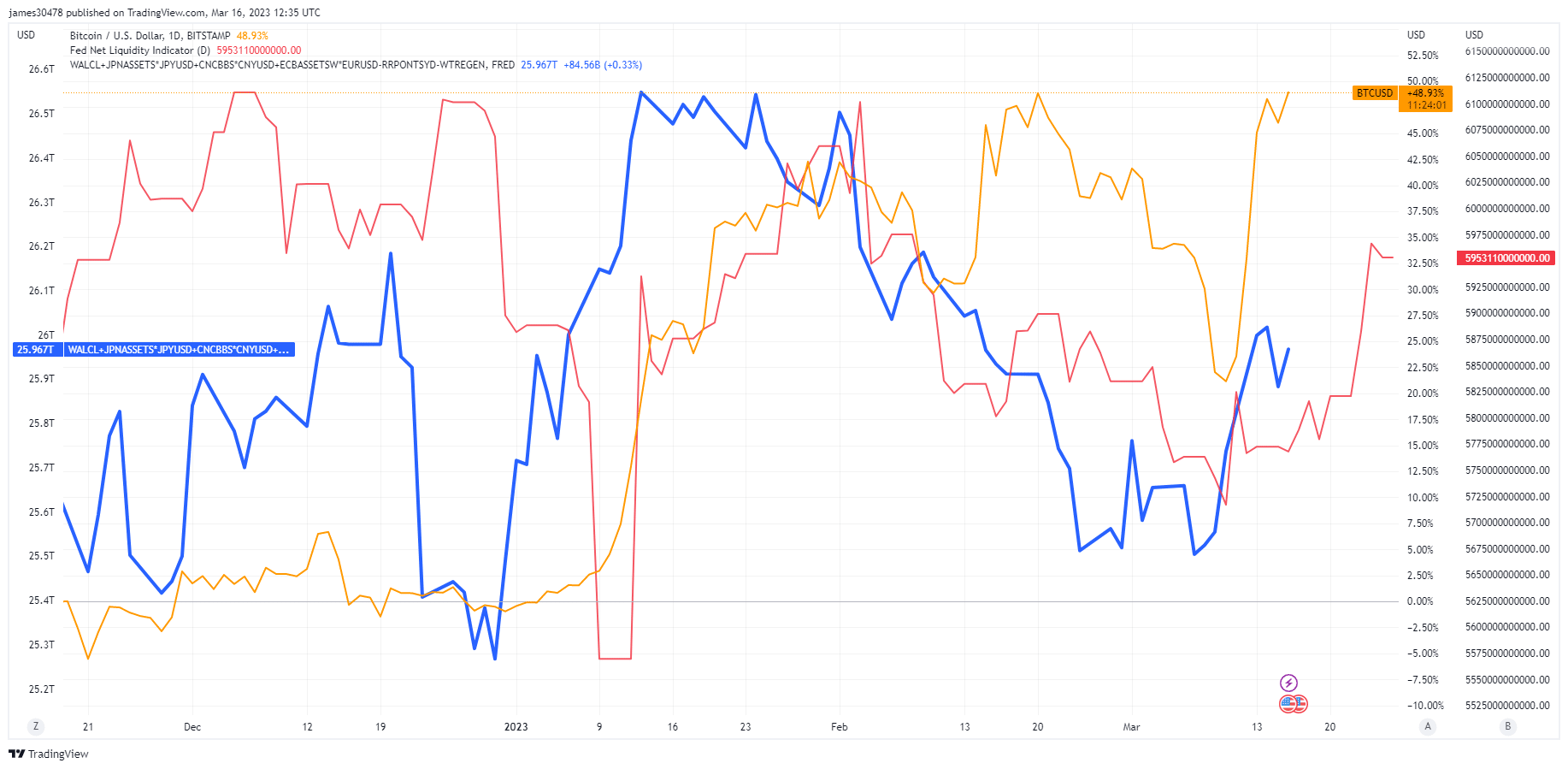

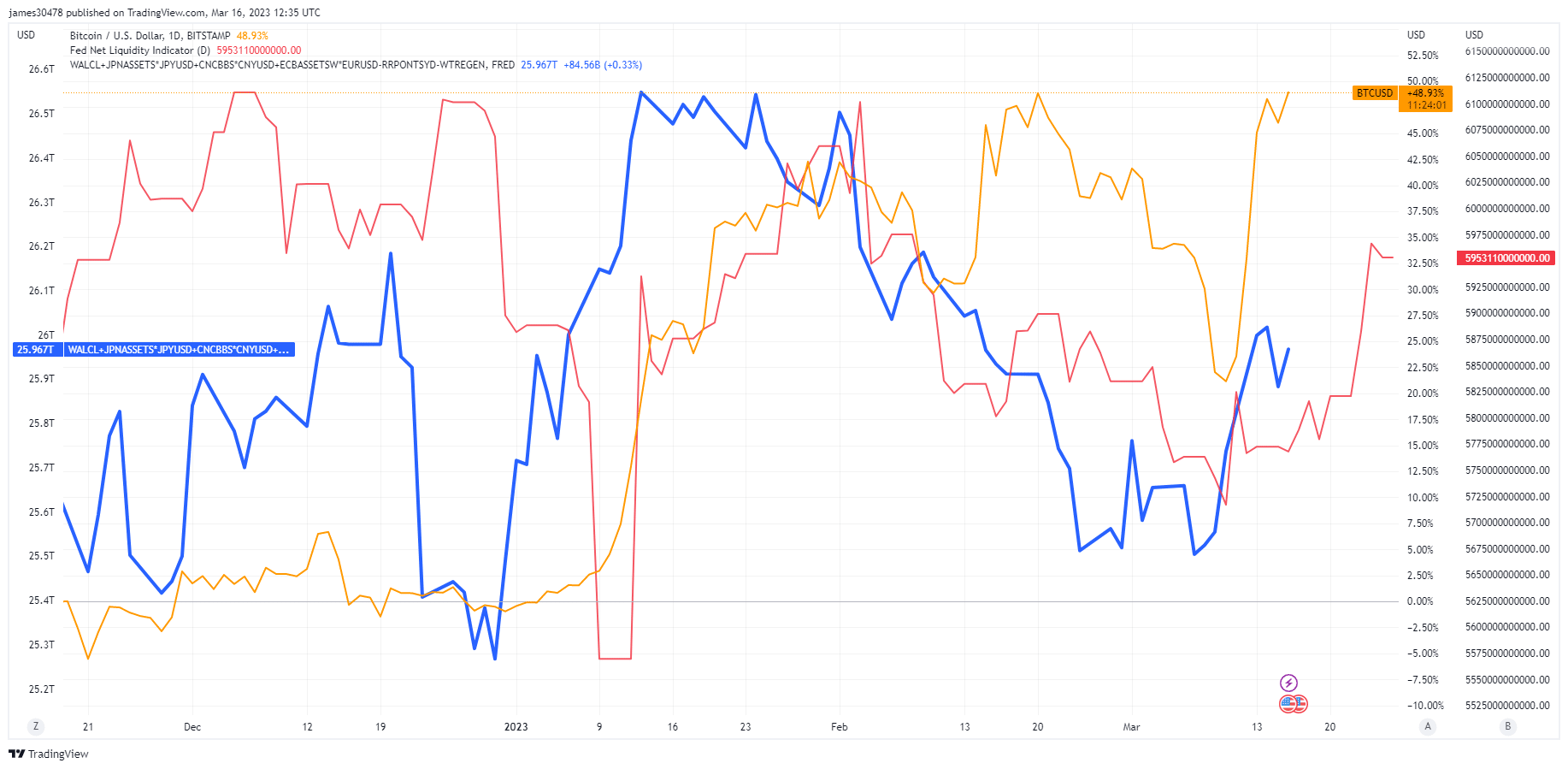

Bitcoin as an indicator for global liquidity, balance sheet growth

Quick Take Many narratives have been attached to Bitcoin, such as an inflation hedge, but one emerging since covid is a global liquidity indicator or the expansion/contraction of balance sheets. The net liquidity indicator we covered in previous insights has grown YTD; Bitcoin has highly correlated with this indicator for the past year. net_liquidity = […]

Don't got time to read? Listen it & multi task

Quick Take

- Many narratives have been attached to Bitcoin, such as an inflation hedge, but one emerging since covid is a global liquidity indicator or the expansion/contraction of balance sheets.

- The net liquidity indicator we covered in previous insights has grown YTD; Bitcoin has highly correlated with this indicator for the past year.

net_liquidity = (fed_bal – (tga + rev_repo))

- While the balance sheet of the four largest central banks accumulatively has increased this year, this includes Japan, Europe, China, and U.S., from $25.6 trillion to $26 trillion.

- For all the work the ECB and Fed are attempting to do with quantitative tightening is being offset by the balance sheet growth of China and Japan.

-

Dwindling order book depth raises liquidity concerns in crypto markets, which could push prices violently to the up or downside.

The post Bitcoin as an indicator for global liquidity, balance sheet growth appeared first on CryptoSlate.