Bitcoin’s price has gained momentum over the past weeks and recently touched a high of more than $69,000, which is only 6% away from its all-time high. However, the high amounts of leverage behind the impressive performance raises concerns about its sustainability. Leverage trading involves using borrowed funds to increase the potential return on an […]

Bitcoin’s price has gained momentum over the past weeks and recently touched a high of more than $69,000, which is only 6% away from its all-time high.

However, the high amounts of leverage behind the impressive performance raises concerns about its sustainability. Leverage trading involves using borrowed funds to increase the potential return on an investment. It allows traders to control a larger position in an asset than they could with their capital alone.

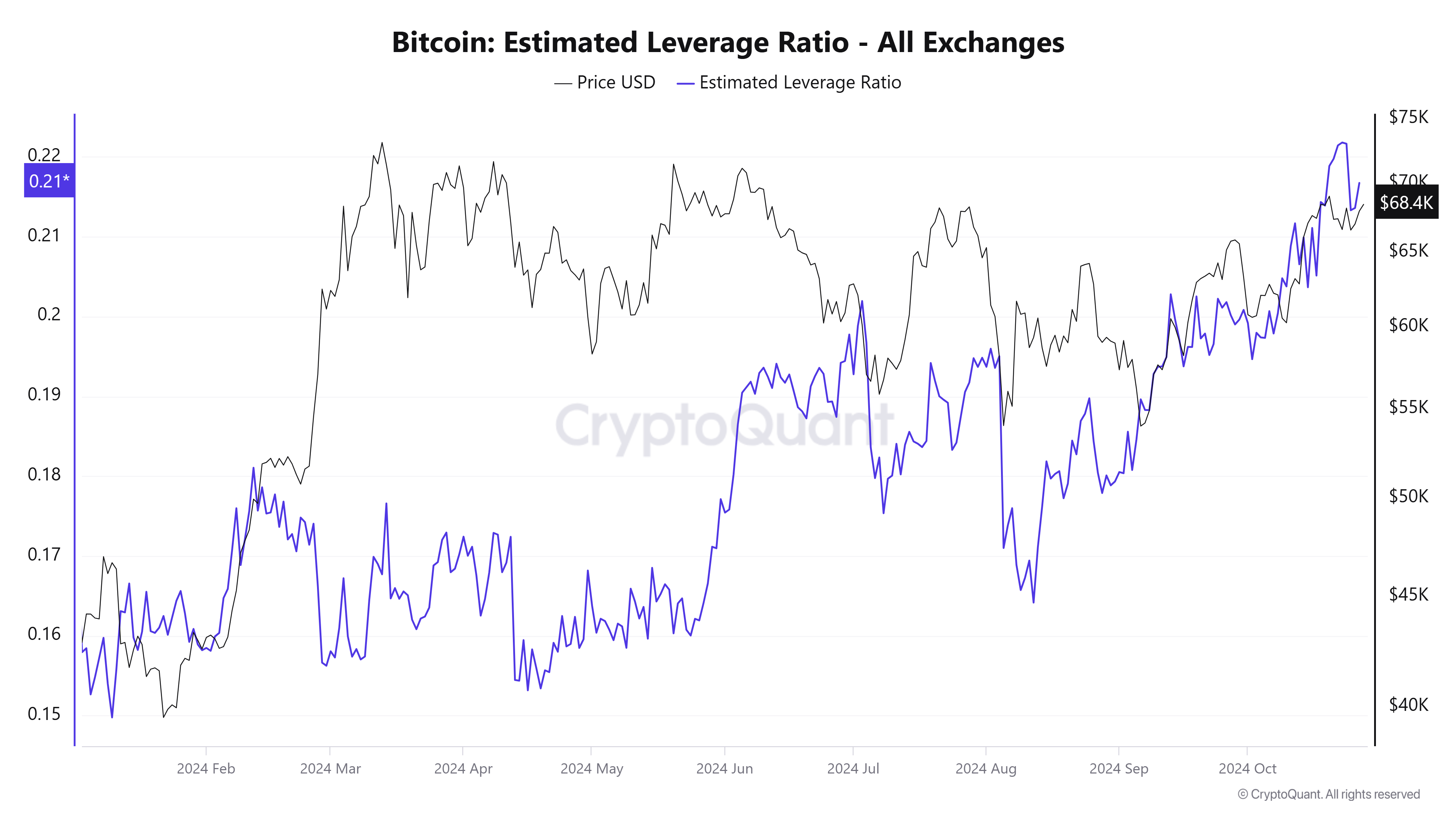

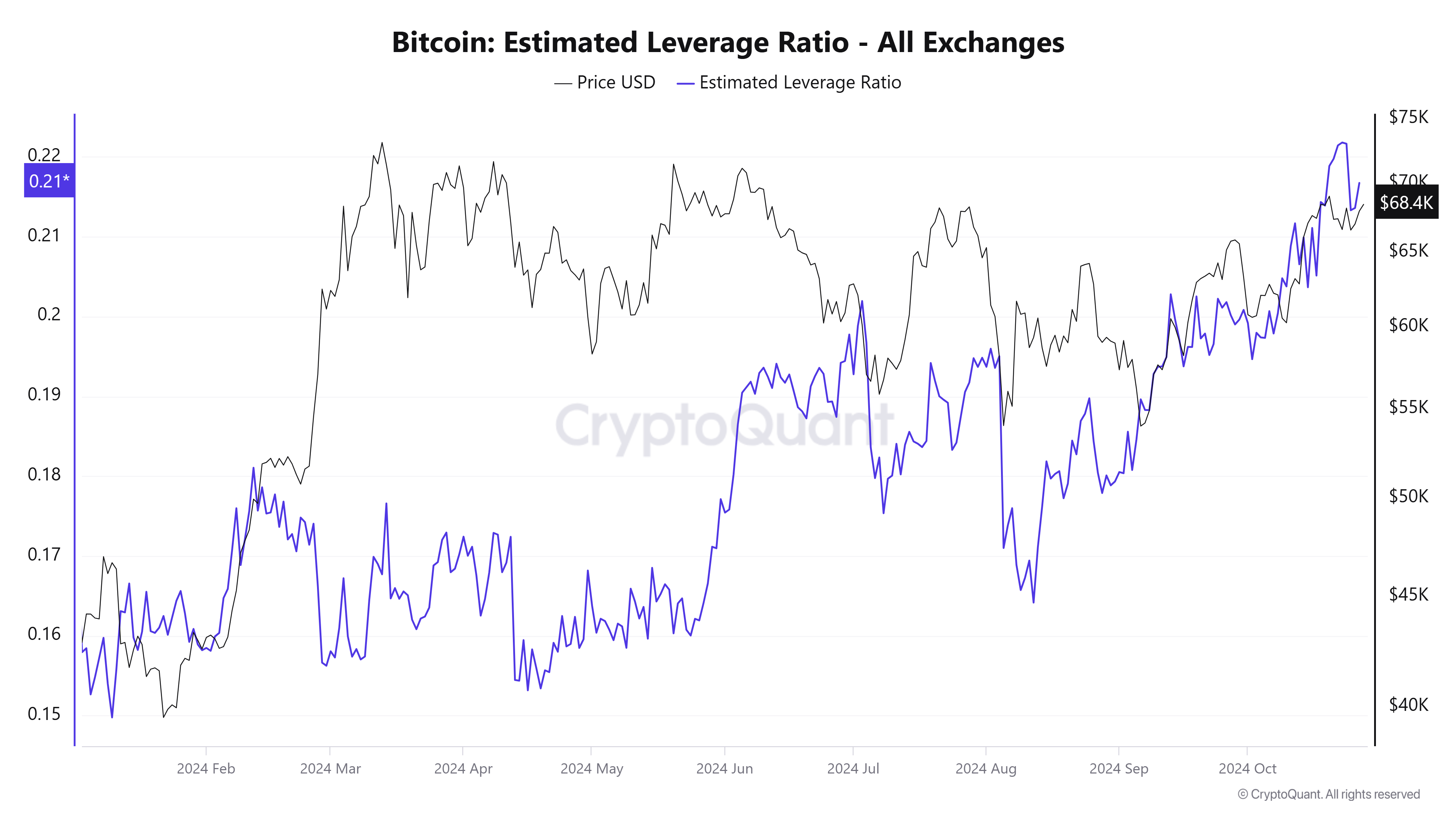

CryptoQuant data indicates that the Estimated Leverage Ratio hit a yearly high of 0.22 on Oct. 24 before slightly declining to 0.21 on Oct. 26. This ratio compares the open interest (OI) in futures contracts to the balance of the corresponding exchange.

Last week, Bitcoin’s open interest had surpassed $40 billion for the first time, setting a new record in the crypto derivatives market.

Although OI dipped to around $37 billion over the weekend, the market has rebounded by 6% in the last 24 hours to $40.08 billion as of press time, according to CoinGlass data. This unsurprisingly contributed to BTC’s price briefly climbing to as high as $69,225 earlier today.

While leverage can amplify profits, it also introduces significant risks, potentially leading to substantial losses and increased market volatility.

The post Bitcoin’s price surge powered by increased leverage appeared first on CryptoSlate.