Bitcoin traded in a tight range on Tuesday as extreme bullish sentiment appears to be cooling. The cryptocurrency was trading at around $62,000 at press time and is roughly flat over the past 24 hours. The bitcoin Fear & Greed Index is starting to decline from its highest level in more than seven months, which […]

Bitcoin traded in a tight range on Tuesday as extreme bullish sentiment appears to be cooling. The cryptocurrency was trading at around $62,000 at press time and is roughly flat over the past 24 hours.

The bitcoin Fear & Greed Index is starting to decline from its highest level in more than seven months, which suggests buyers are starting to take some profits after a nearly 45% rise in BTC’s price over the past month.

In the bitcoin futures market, leveraged funds on the Chicago Mercantile Exchange (CME) raised their bets against bitcoin rising to a record high in the week ended Oct. 19, possibly to profit from the widening gap between futures and spot markets prices, CoinDesk’s Omkar Godbole reported.

For now, technical indicators suggest limited pullbacks after a retest near the $60,000 support level in bitcoin’s price was achieved earlier this week.

Latest Prices

- Bitcoin (BTC): $62,020.52, -1.29%

- Ether (ETH): $4,224.98, +0.65%

- S&P 500: $4,574.79, +0.18%

- Gold: $1,793.80, -0.79%

- 10-year Treasury yield closed at 1.62%

Slight profit taking

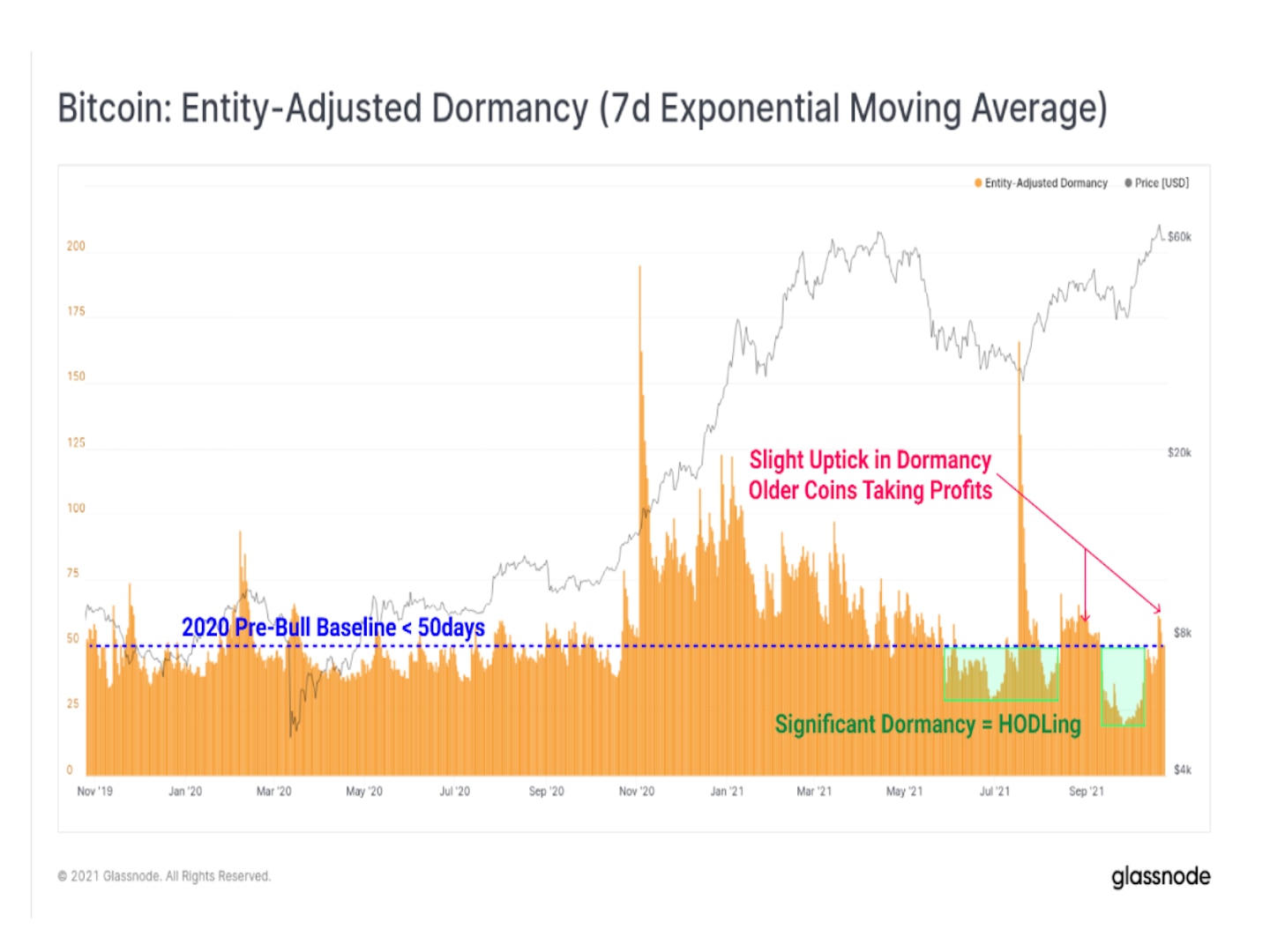

Blockchain data show long-term bitcoin holders are starting to take some profits, which typically occurs when BTC reaches an all-time high.

Based on the current price cycle, profit-taking from long-term holders appears to be modest relative to extreme levels seen at the end of a bull market phase, according to a blog post from Glassnode.

The chart below shows significant accumulation of bitcoin around mid-September during a pullback in BTC’s price. And despite the slight profit-taking, current positioning by long-term holders is consistent with the early phase of a bull market, according to Glassnode.

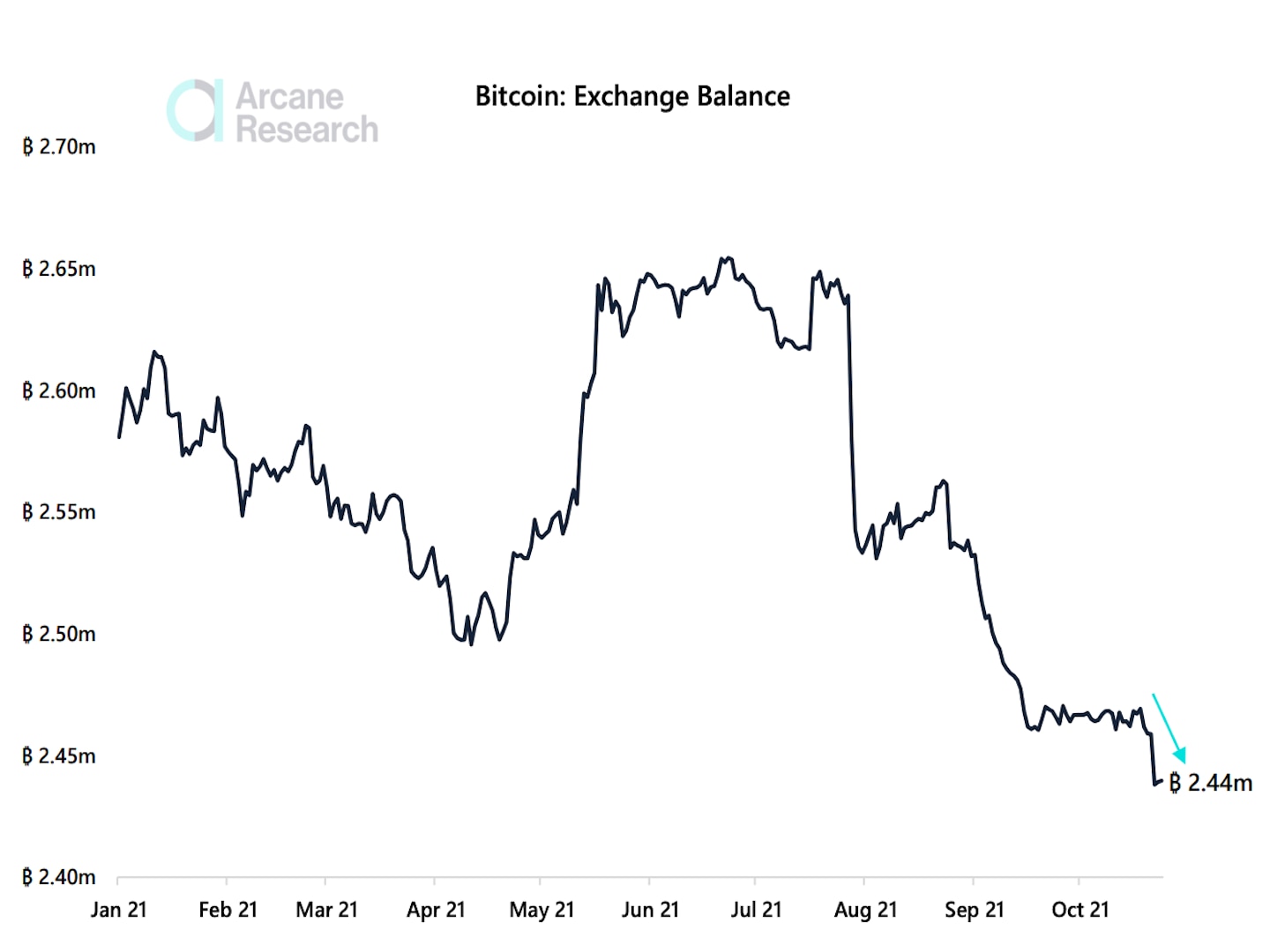

Bitcoin balance on exchanges declines

The total balance of bitcoin on exchanges continues to decline, which suggests traders are holding coins in wallets instead of making them available to trade on an exchange.

“Relative to the circulating supply, the bitcoin balance at exchanges sits at levels not seen since January 2018,” Arcane Research wrote in a Tuesday newsletter. “This could suggest that the demand to sell is low at the moment.”

Taproot priced in?

The last time the Bitcoin network locked in a major upgrade, in July 2017, the cryptocurrency’s price jumped almost 50% through Aug. 23 of that year, when the changes went live.

Now, as the original blockchain network prepares for its next big upgrade in November, an upgrade that is known as Taproot, few investors are expecting a price reaction anywhere near that scale.

BTC’s price has already doubled this year and hit a new all-time high near $67,000 last week. While further gains are possible, Taproot alone likely won’t be the catalyst, CoinDesk’s Lyllah Ledesma wrote.

Read more here.

Altcoin roundup

- Solana-based perpetual swaps DEX Drift Protocol raises $3.8 million: Crypto derivatives exchange Drift Protocol raised $3.8 million in a seed funding round that was led by Multicoin Capital with participation from crypto trading firms Jump Capital and Alameda, among others, CoinDesk’s Danny Nelson reported. Drift, which focuses on perpetual swaps, or futures contracts without an expiration date, is set to launch this month with support for SOL, BTC, ETH and Solana ecosystem tokens.

- Stablecoin protocol Frax’s governance token surges 80% on supply squeeze: Fractional-algorithmic stablecoin protocol Frax has jumped 80% in a single day, gaining nearly twice what bitcoin has done so far this month, CoinDesk’s Omkar Godbole reported. The protocol now trades near $14.40, according to data provided by Messari.

- Tether enlists startup to help it comply with money laundering rules: Stablecoin issuer Tether has begun a trial partnership with startup software company Notabene to help combat money laundering in cross-border transactions, CoinDesk’s Cheyenne Ligon reported. Notabene, which provides software to crypto exchanges to help identify their users and track transactions, will help Tether comply with the Financial Action Task Force’s (FATF) “travel rule,” which requires disclosure of customer information of relevant transactions.

Relevant News

- Valkyrie Files to Offer Leveraged Bitcoin Futures ETF

- DCG’s $1B Pledge and an SEC Filing Kindle Fresh Speculation on ‘Grayscale Discount’

- ‘Data Pipeline’ Protocol KYVE Raises $2.8M From Industry Insiders

- Winklevoss-Led Gemini Behind Bitcoin White Paper Excerpts on NYC Billboard

Other markets

Most digital assets in the CoinDesk 20 ended the day higher.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- The Graph (GRT): +11.04%

- Polygon (MATIC): +10.64%

- Aave (AAVE): +10.15%

Notable losers:

- Bitcoin (BTC): -1.46%

- Filecoin (FIL): -0.79%

- Dogecoin (DOGE): -0.56%