The world’s leading payment services provider processed $145.60 million worth of Bitcoin trades on the day BTC rallied to its record high of $67,000. Bitcoin (BTC) trading volumes on global payment service provider PayPal reached $145.60 million on Oct. 20, just as the benchmark crypto rallied toward its record high near $67,000. The latest spike […]

The world’s leading payment services provider processed $145.60 million worth of Bitcoin trades on the day BTC rallied to its record high of $67,000.

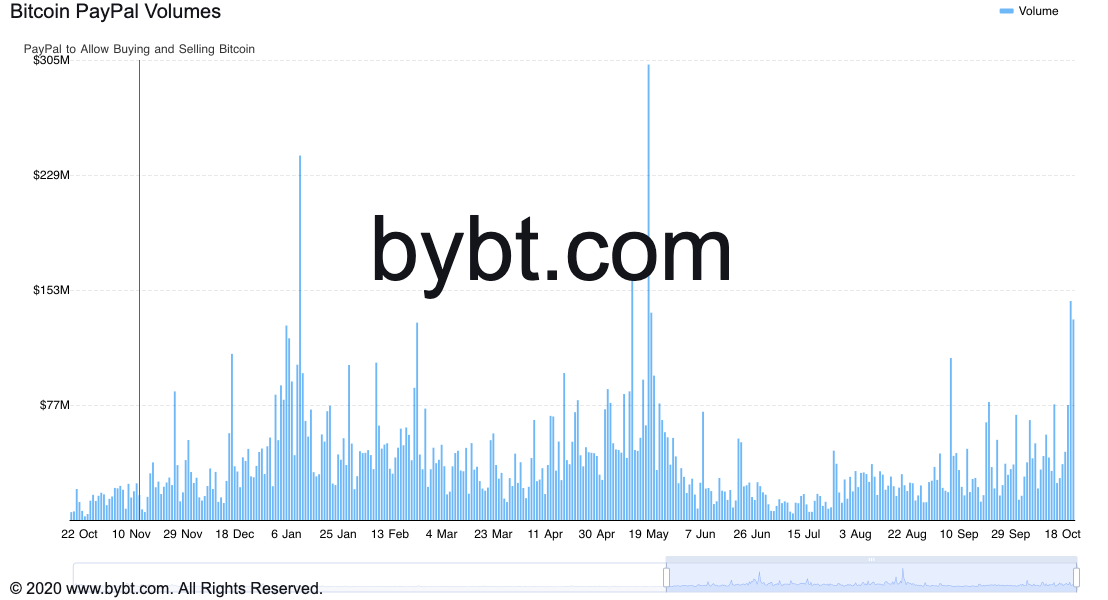

Bitcoin (BTC) trading volumes on global payment service provider PayPal reached $145.60 million on Oct. 20, just as the benchmark crypto rallied toward its record high near $67,000.

The latest spike in volumes came out to be the highest since the May 19 Bitcoin price crash from around $43,500 to as low as $30,000. On the day, some $304 million worth of BTC changed hands, almost double the volumes logged on Oct. 20.

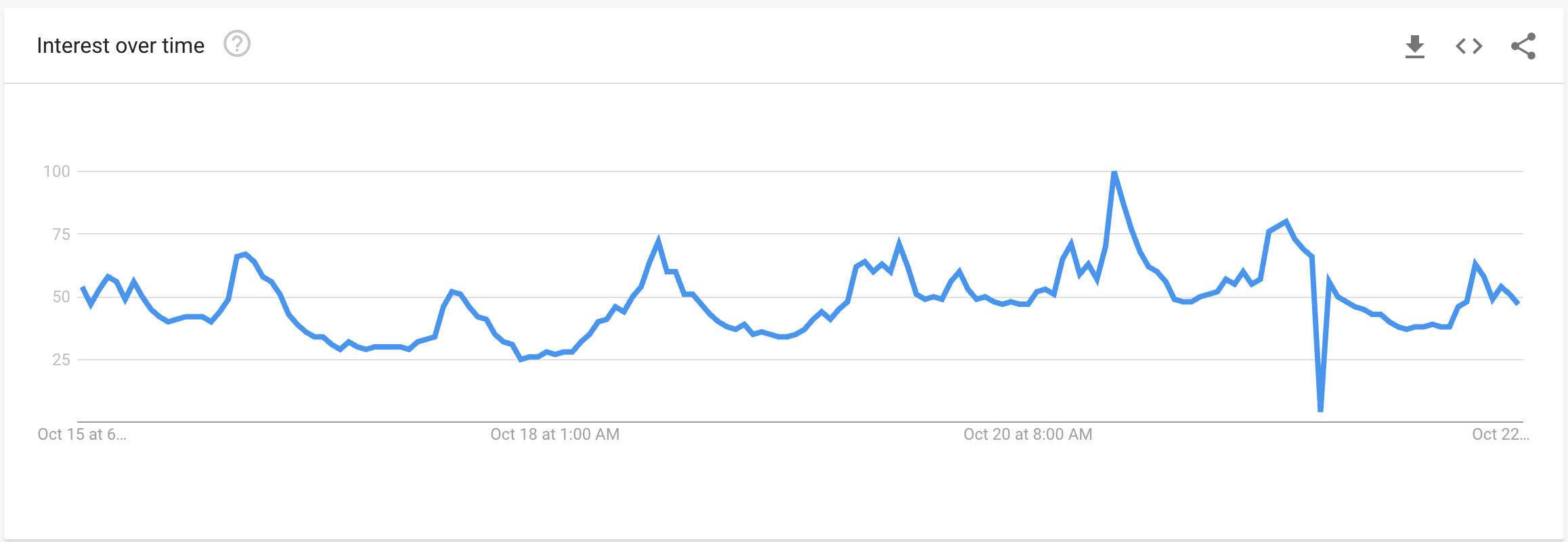

Nonetheless, in both instances, it was unclear if the volumes were due to the increase in purchasing during the Bitcoin price rally or selloffs near the newly-achieved highs. Whatever may be the reason, the PayPal readings reflected a rise in retail activity on Oct. 20, further attested to by a spike in internet queries for the keyword “Bitcoin.”

Retail boom?

Notably, PayPal allows users to start investing in Bitcoin by putting as little as $1. As a result, the payment service firm has emerged as a viable platform for retail investors, a move seen by the industry as a cue for wider crypto adoption.

Interestingly, since PayPal’s push into the crypto sector, the sum count of unique addresses holding at least $1 worth of BTC has surged from 26.83 million on Nov. 20, 2020, to 33.89 million at press time. Meanwhile, on Oct. 20, the count was 34.12 million, an all-time high.

Alexander Vasiliev, co-founder/chief customer officer of crypto payment service Mercuryo, saw PayPal’s foray into the crypto industry as a sign of retail boom. He expected Bitcoin to end the fourth and final quarter of 2021 in profits as everyday traders look for safety nets against a persistently rising inflation.

Related: Bitcoin extends correction as Ethereum sees ‘picture perfect rejection’ at all-time highs

“The increased buying pressure from PayPal users and its corresponding impact on the price of Bitcoin may stir a notable up-shoot this fourth quarter and as the year runs to an end,” Vasiliev told Cointelegraph, adding:

“The company has millions of customers and a massive buy-up of BTC can effectively push Bitcoin to new highs […] With the ATH at $67k, we may see a worse case price hit of $80,000 by year-end and a best-case scenario of $100,000.”

PayPal has around 392 million active users worldwide, but its crypto services are available only in the United States and the United Kingdom. Meanwhile, the company is also eyeing an entry into the decentralized finance (DeFi) sector, signaling expansion outside the Bitcoin sector.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.