Quick Take Over the past months, the U.S. national debt has witnessed a rapid acceleration. As reported by CryptoSlate in June, the national debt was on the verge of hitting the $32 trillion mark. Fast forward to the present day, the national debt now stands at a staggering $32.9 trillion, closing in fast on the […]

Quick Take

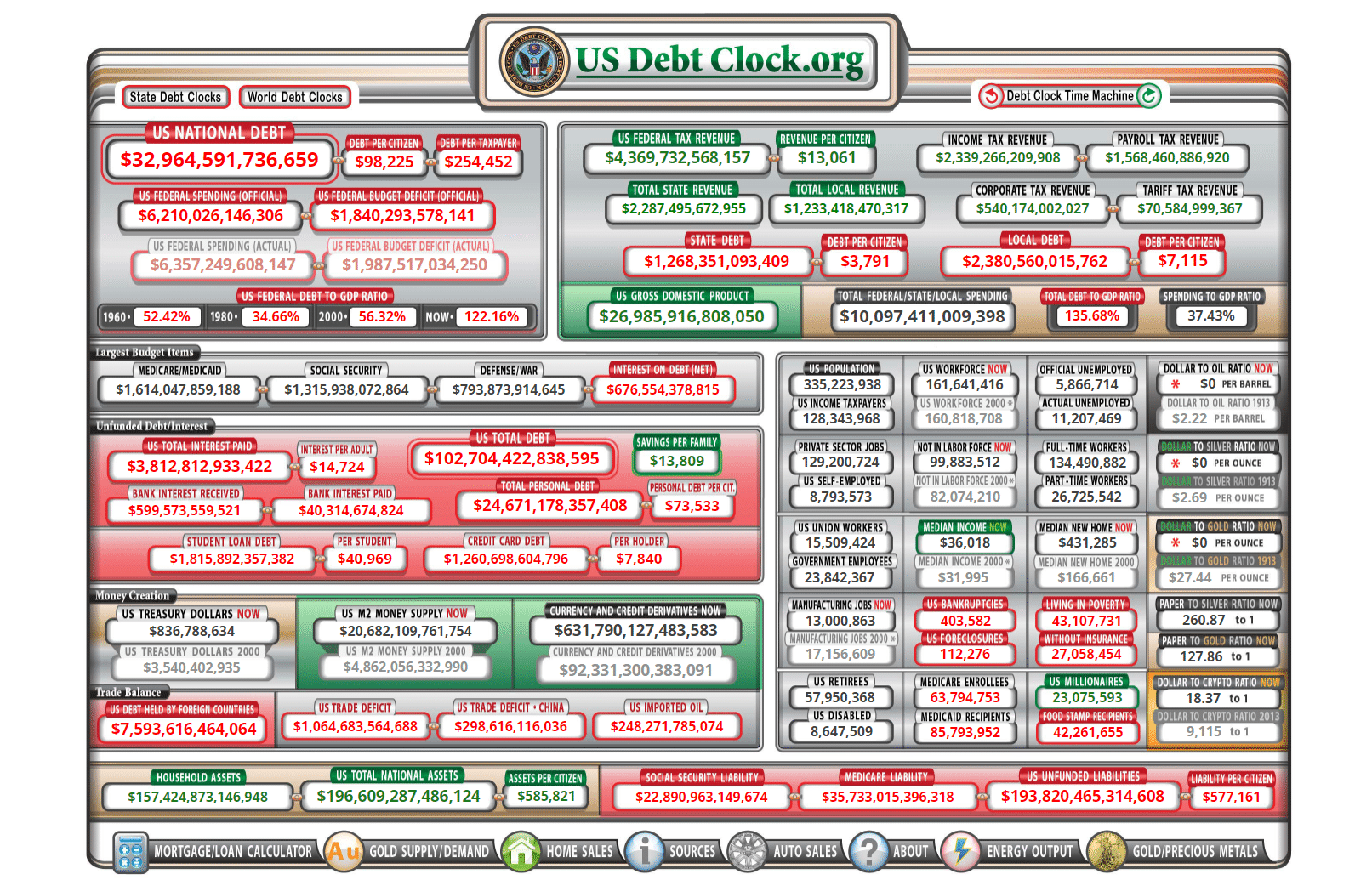

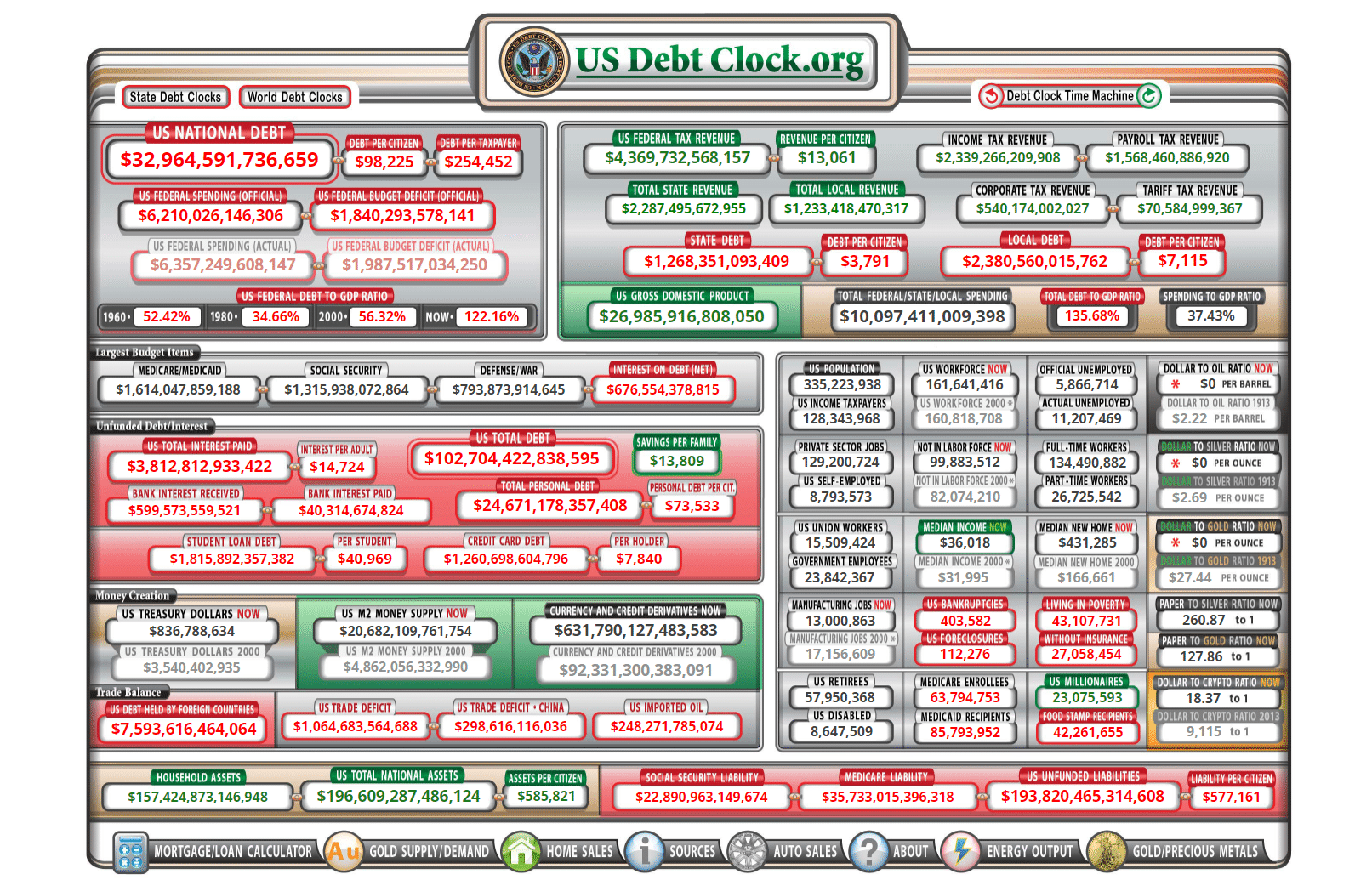

Over the past months, the U.S. national debt has witnessed a rapid acceleration. As reported by CryptoSlate in June, the national debt was on the verge of hitting the $32 trillion mark. Fast forward to the present day, the national debt now stands at a staggering $32.9 trillion, closing in fast on the $33 trillion barrier. This signifies a growth trajectory that could have far-reaching impacts on the economy and various sectors, including the crypto market.

The potential implications of this surging debt are manifold. While it could potentially signal increased government spending, which might stimulate the economy in the short run, an unchecked rise in national debt could also lead to long-term fiscal instability. In the context of the cryptocurrency market, a heightened national debt may fuel discussions about digital assets’ potential role as a hedge against traditional financial market instabilities, although this perspective remains a subject of ongoing debate.

The post U.S. national debt nears $33T, reigniting debate on crypto as financial hedge appeared first on CryptoSlate.