After a bearish start, Ethereum (ETH) has traded within a narrow range through October, facing resistance at $2,736 and finding support at $2,326. As the new trading month begins, analysts anticipate a potential rally — contingent on a key condition: ETH must break through its resistance level to confirm bullish momentum. Why Ethereum May Be […]

After a bearish start, Ethereum (ETH) has traded within a narrow range through October, facing resistance at $2,736 and finding support at $2,326.

As the new trading month begins, analysts anticipate a potential rally — contingent on a key condition: ETH must break through its resistance level to confirm bullish momentum.

Why Ethereum May Be Held Down

In an exclusive interview with BeInCrypto, Victor Tan, founder and CEO of TrinityPad — a launchpad empowering investors to support early-stage companies — shared that Ethereum could test the $3,500 to $4,000 range by November. Tan attributed this anticipated growth to recent advancements in Layer-2 solutions and the expanding integration of decentralized finance (DeFi) on the platform.

“ETH could advance toward $3,500-$4,000 by year-end if DeFi adoption continues expanding. Layer-2 technologies have already lowered transaction fees by around 20%, enhancing Ethereum’s appeal,” he said.

However, the recent underperformance of Ethereum’s DeFi sector in the past month has inspired little confidence. Data from DeFiLlama shows that the Layer-1 (L1) network saw only a modest 2% increase in total value locked (TVL) over the past 30 days. In comparison, competing networks gained significant momentum, with “Ethereum killer” Solana achieving a 12% increase in TVL and Aptos surging by an impressive 47% within the same period.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

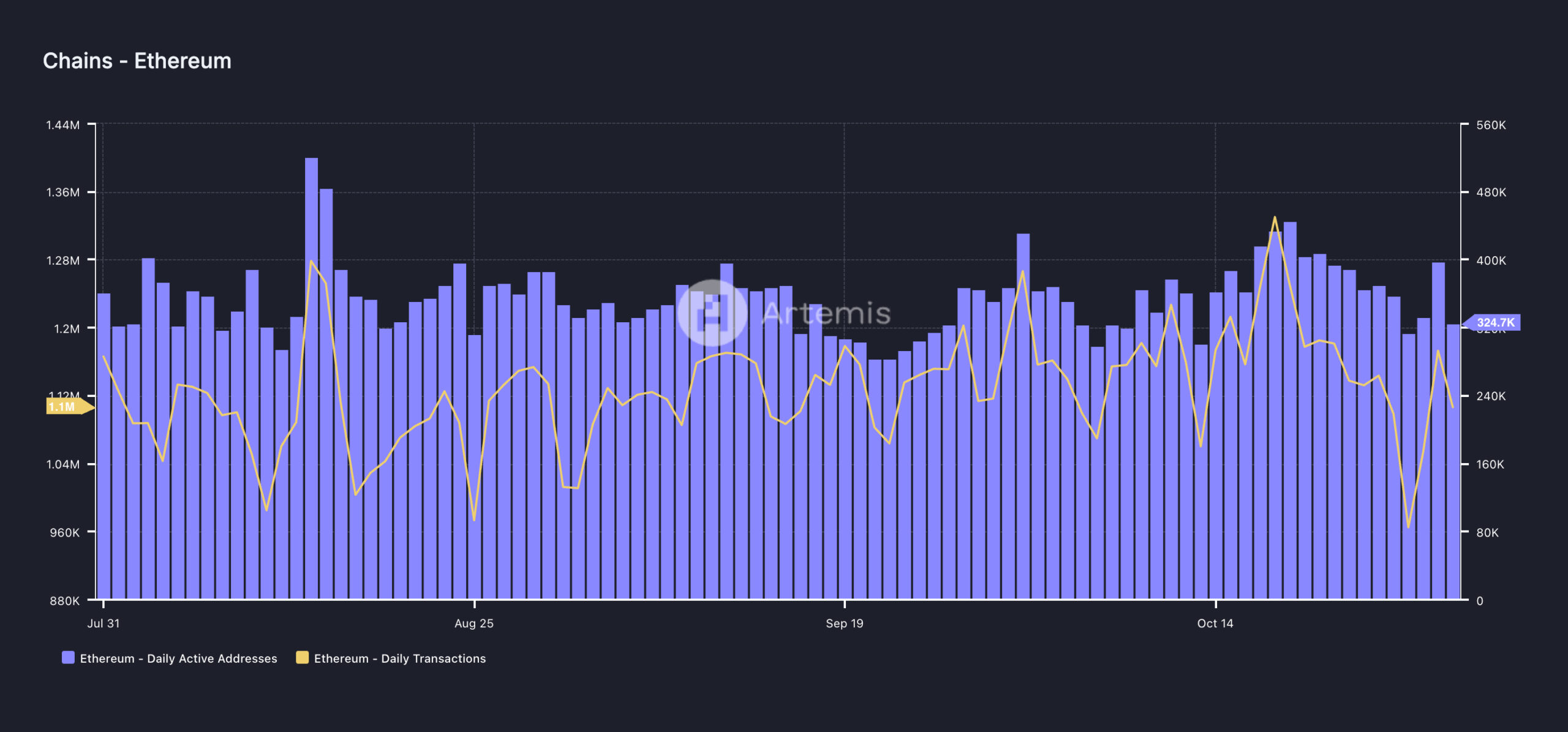

Ethereum’s poor TVL growth reflects the network’s low demand over the past month. Data from Artemis shows that the daily active addresses on the chain have totaled 324,745 in the past 30 days, dropping by 25%.

Due to the fall in user count on the chain, Ethereum’s daily transaction count has also plummeted. During the period under review, this has dropped by 13%.

Ethereum Coins in Circulation Spike

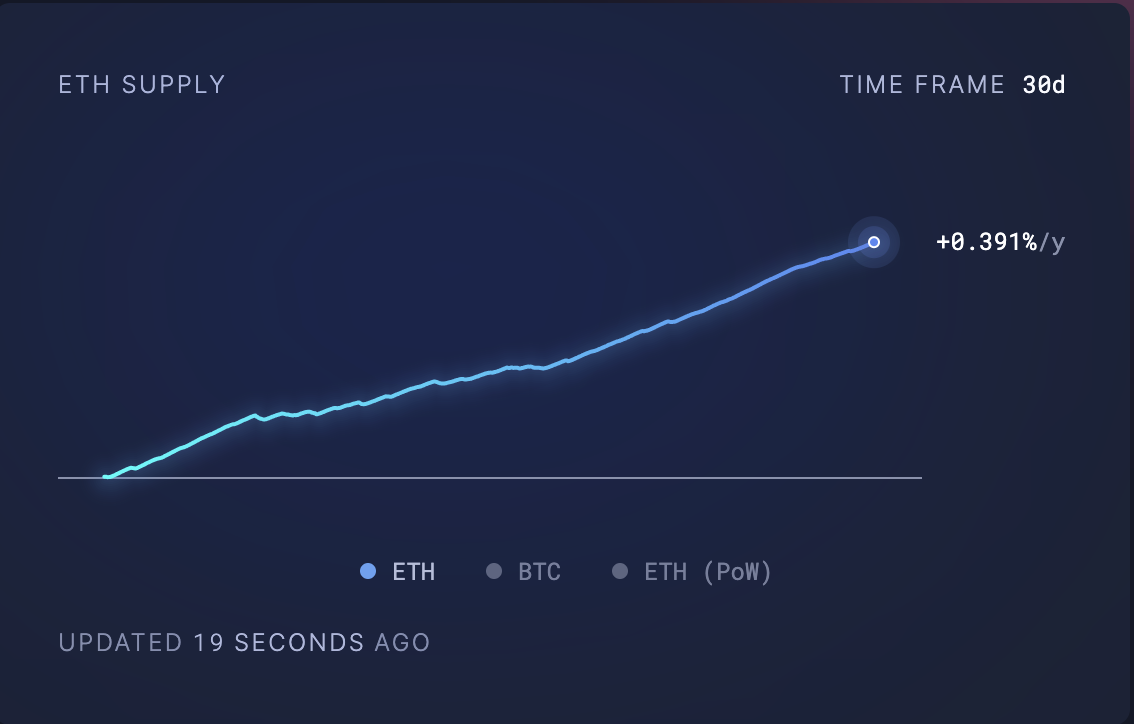

The decline in activity on the Ethereum network has reduced the altcoin’s burn rate. This has increased its circulating supply and exerted downward pressure on its price.

Data from Ultrasoundmoney shows that, over the past 30 days, an additional 38,598 ETH — valued at over $98 million at current market prices — has been added to Ethereum’s circulating supply.

Read more: How to Invest in Ethereum ETFs?

When more ETH tokens enter circulation, the available supply rises, which can lead to a price dip as supply outpaces demand. This influx of tokens may contribute to short-term price volatility in November, especially if network activity remains subdued.

The post What to Expect from Ethereum (ETH) in November 2024: Analysts Weigh In appeared first on BeInCrypto.